Accounting and Finance with Foundation Year

NN3XAccountants are indispensable to every business. At Winchester we are passionate about enhancing your digital capabilities and agile thinking to make sure that you thrive in this core and rapidly evolving industry. In your Foundation Year you will develop your academic skills and gain a thorough understanding of Accounting and related subjects within the faculty.

Course overview

Our Accounting and Finance Programme Team have been nominated for the PQ Magazine 2025 award for 'Accountancy College of the Year' in the public sector.

Our hugely rewarding and practical Accounting and Finance course develops the technical knowledge and professional skills required for a modern finance professional in a complex, dynamic world in which technical roles are increasingly automated.

You are taught by academics with professional experience as accountants, who support your personal development and help kick-start rewarding and fulfilling careers in multiple fields.

Throughout the course, you will develop a range of transferable abilities and professional practice skills highly valued by employers. These include critical evaluation, self-direction and problem-solving, as well as a sound grasp of analysis, presentations and negotiation techniques. Learning and teaching takes place in small class sizes to prepare you to work in management teams, and modules focus on applying theory to real business scenarios. You will also have the opportunity to attend occasional field trips during the course.

A Foundation Year is the perfect way to boost your academic skills, build your confidence and develop your wider subject knowledge so you can succeed at Winchester. This course offers an extra year of study at the start (Year 0) which leads onto a full degree programme (Years 1, 2 and 3) where you may choose to spend a year on a paid work placement before your final year.

In Year 0, you will study a set of modules from across the Faculty of Business and Digital Technologies which are designed to develop your academic and practical skills. This broader focus in your first year introduces you to studying at university level and provides you with a better understanding of Accounting and related subjects. You will also receive support to boost your academic skills to prepare you for the rest of your time at Winchester.

We tend to favour workshop-style sessions over lectures and you will have the opportunity to apply cutting-edge knowledge and skills to real life scenarios. Live briefs, simulations, role play and live case studies will be used to recreate workplace conditions.

What you need to know

Course start date

September

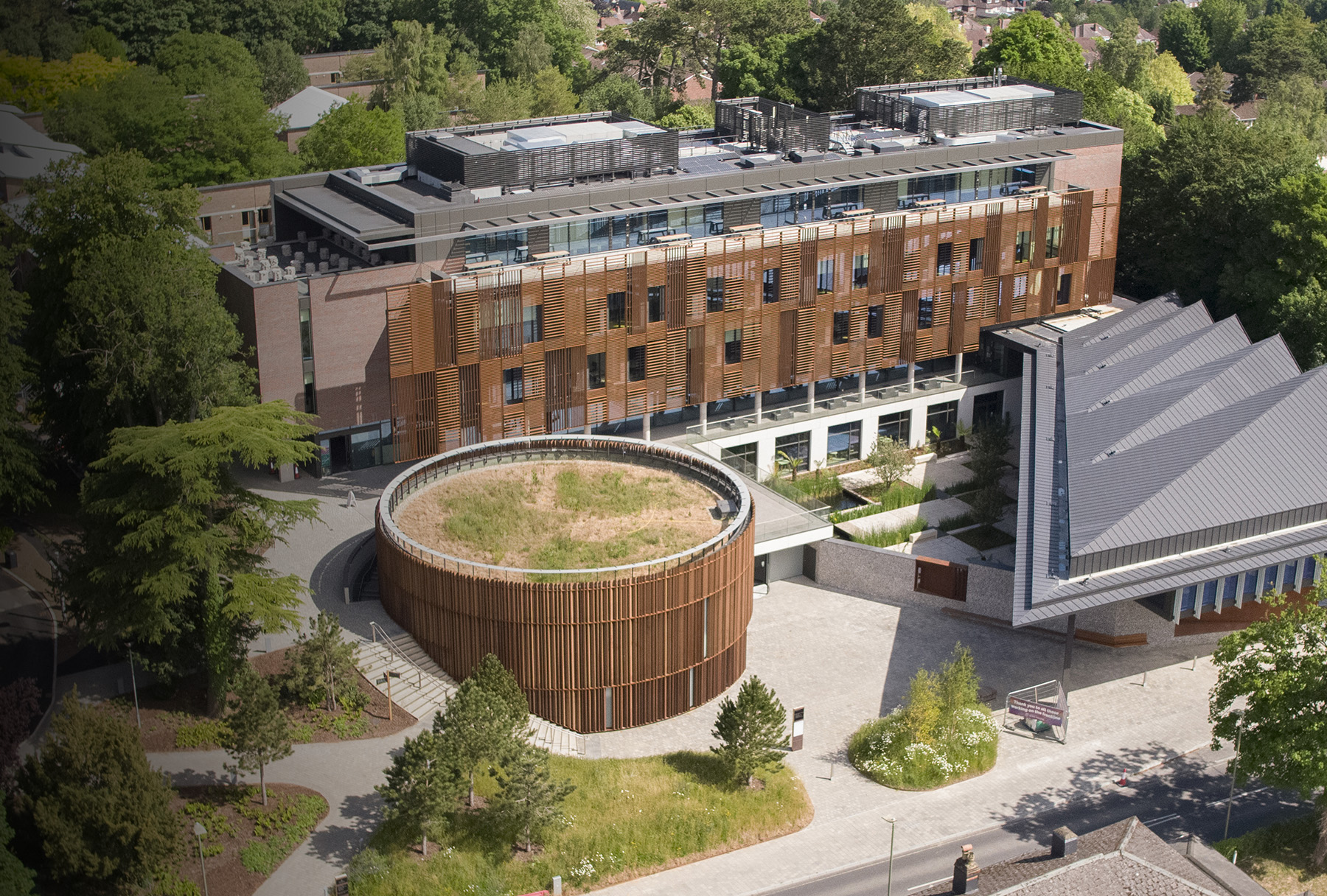

Location

Winchester campus

Course length

- 4 years full-time

- 5 years sandwich (with industry placement)

Apply

NN3X

Typical offer

48 points

Fees

From £5,760 pa (Foundation year)

Why Winchester

- Develop a systematic understanding of current issues in accounting to meet the needs of a globalised profession in the 21st century

- Apply your advanced knowledge to real business scenarios

- Receive exemptions from selected professional examinations from the main accounting institutes depending on the choice of modules you study

- The BA (Hons) degree is Accredited by the Institute of Chartered Accountants in England and Wales (ICAEW), the Chartered Institute of Management Accountants (CIMA) and the Association of Chartered Certified Accountants (ACCA)

Course details

Our aim is to shape 'confident learners' by enabling you to develop the skills needed to excel in your studies here and as well as onto further studies or the employment market.

You are taught primarily through a combination of lectures and seminars, allowing opportunities to discuss and develop your understanding of topics covered in lectures in smaller groups.

In addition to the formally scheduled contact time such as lectures and seminars, you are encouraged to access academic support from staff within the course team and the wide range of services available to you within the University.

Independent learning

Over the duration of your course, you will be expected to develop independent and critical learning, progressively building confidence and expertise through independent and collaborative research, problem-solving and analysis with the support of staff. You take responsibility for your own learning and are encouraged to make use of the wide range of available learning resources available.

Overall workload

Your overall workload consists of class contact hours, independent learning and assessment activity.

While your actual contact hours may depend on the optional modules you select, the following information gives an indication of how much time you will need to allocate to different activities at each level of the course.

Year 0 (Level 3): Timetabled teaching and learning activity*

- Teaching, learning and assessment: 288 hours

- Independent learning: 912 hours

Year 1 (Level 4): Timetabled teaching and learning activity*

- Teaching, learning and assessment: 288 hours

- Independent learning: 912 hours

Year 2 (Level 5): Timetabled teaching and learning activity*

- Teaching, learning and assessment: 288 hours

- Independent learning: 912 hours

Year 3 (Level 6): Timetabled teaching and learning activity*

- Teaching, learning and assessment: 240 hours

Independent learning: 960 hours

*Please note these are indicative hours for the course.

Location

Taught elements of the course take place on campus in Winchester.

Teaching hours

All class based teaching takes places between 9am – 6pm, Monday to Friday during term time. Wednesday afternoons are kept free from timetabled teaching for personal study time and for sports clubs and societies to train, meet and play matches. There may be some occasional learning opportunities (for example, an evening guest lecturer or performance) that take places outside of these hours for which you will be given forewarning.

Assessment

Our validated courses may adopt a range of means of assessing your learning. An indicative, and not necessarily comprehensive, list of assessment types you might encounter includes essays, portfolios, supervised independent work, presentations, written exams, or practical performances.

We ensure all students have an equal opportunity to achieve module learning outcomes. As such, where appropriate and necessary, students with recognised disabilities may have alternative assignments set that continue to test how successfully they have met the module's learning outcomes. Further details on assessment types used on the course you are interested in can be found on the course page, by attending an Open Day or Open Evening, or contacting our teaching staff.

Percentage of the course assessed by coursework

The assessment balance between examination and coursework depends to some extent on the optional modules you choose. The approximate percentage of the course assessed by different assessment modes is as follows:

Year 0 (Level 3)*:

- 83% coursework

- 17% practical exams

Year 1 (Level 4)*:

- 29% coursework

- 60% written exams

- 11% practical assessment

Year 2 (Level 5)*:

- 47% coursework

- 42% written exams

- 11% practical assessment

Year 3 (Level 6)*:

- 36% coursework

- 53% written exams

- 11% practical assessment

*Please note these are indicative percentages and modes for the programme.

Feedback

We are committed to providing timely and appropriate feedback to you on your academic progress and achievement in order to enable you to reflect on your progress and plan your academic and skills development effectively. You are also encouraged to seek additional feedback from your course tutors.

Further information

For more information about our regulations for this course, please see our Academic Regulations, Policies and Procedures.

Student satisfaction

As rated by final year undergraduate students in the 2017 National Student Survey, Accounting and Finance achieved greater than 90 % overall satisfaction.

Modules

Please note the modules listed are correct at the time of publishing. The University cannot guarantee the availability of all modules listed and modules may be subject to change. The University will notify applicants of any changes made to the core modules listed. For further information please refer to winchester.ac.uk/termsandconditions

Modules

This module is designed to support students with the transition to university, the development of the academic skills and attributes necessary for successful future study and the foundations of a developing sense of vocation. Through a carefully structured and scaffolded series of seminars and workshops, students will be supported in building their self-awareness of, and confidence in, themselves as active learners. Delivered in the context of their subject area and aligned with the development of academic skills and attributes required across all Foundation Year modules, workshops will focus on academic skills such as referencing, selecting and using valid academic resources, reading/researching for academic purposes, using feedback constructively and gaining confidence in contributing to discussions and debates. Coordinated assessment points across the Foundation Year experience enables this module to provide students with ongoing support and opportunities to practice and develop their skills and confidence with a range of written and oral assessment types relevant to their subject area as they progress through the year.

This module is designed to raise students’ knowledge and competence in commercial awareness and digital skills so that they will be able to cope with the necessary demands of the undergraduate business and computing degrees. Students will be trained in a range of business and digital skills, reflecting and discussing how the development of their IT skills can enable future success at university and in the workplace.

This module introduces students to business management as an academic discipline through exploring a range of approaches, theories and contemporary themes. Specifically, students will study a range of topics and begin to understand the ways in which strategy, people, markets, finance, and ethical issues are entwined with, and impact upon, responsible business.

Modules

This module aims to develop the fundamental concepts and practices of financial accounting and the application of this knowledge to different forms of business organisations. With a focus on using the IASB’s Conceptual Framework and accounting for transactions and events from first principles, you will develop your conceptual understanding of accounting, your knowledge of the main accounting terminology and your awareness of the nature and purpose of financial reporting. You will acquire the techniques of double entry accounting and how to apply its principles in recording transactions, adjusting financial records and preparing non-complex financial statements.

The module introduces management accounting as a specialised service function primarily involving the collection, storage and recording of financial data, its conversion to useful information and the effective communication of this information for decision making. It prepares you for more advanced aspects of management accounting and finance encountered later in the programme.

This module provides you with a holistic view of how an entity’s performance can be affected by both its own internal operating environment and the external environment. It develops your knowledge and skills in understanding and applying the legal principles in the context of the business environment and to educate students on lawful and ethical behaviours for professional accountants. You will study various aspects of management theory, external environment mapping and uses of technology by businesses and finance professionals.

Whatever your future career, there are certain professional skills that are required in the workplace. This module provides opportunities to acquire and apply essential skills for academic success, while also developing digital skills that are a prerequisite for a successful career. You will practice, and build confidence in wide ranging skills, as part of your transition into higher education. By establishing and pursuing a personal development plan, you will develop a set of personal qualities such as self-awareness, confidence and resilience; and professional skills such as communication, teamwork, risk management, coaching and feedback. Whilst you learn to construct outstanding CVs and professional LinkedIn profiles, this module also aims to raise your digital skills competencies. The module will cover the general Microsoft Office suite and specific digital skills of particular relevance to the discipline that the you are studying. This module is taught as a mix of lectures, practitioner guest lectures, hands-on skills seminars and computer lab sessions.

Modules

This module enables you to develop your understanding and competence in using diverse research methods for academic and professional purposes. You will explore a variety of research approaches and will develop practical qualitative and quantitative research skills including defining and scoping a project; designing an effective and manageable research protocol; collecting data and using appropriate analysis methods. In addition, you will develop an appreciation of ethical implications of the research process to facilitate responsible research practice. Secondly this module aims to introduce you to the key stages required to complete an applied project from concept to delivery. You will be taught how to manage a project and contribute effectively as a member of a project team, using ideas generation techniques and problem-solving skills to develop innovative solutions to business problems. This module contributes to your continued professional development as you gain key insights into how to perform technical process improvement tasks in a range of environments to solve business problems.

This module builds on the knowledge of financial accounting from year 1 by requiring you to extend your understanding of double entry bookkeeping to the application of the International Financial Reporting Standards (IFRS). The approach to teaching the IFRS will be Framework-based, an approach recommended by the IASB. The Framework-based approach develops a critical understanding of the well-established principles around corporate reporting. You will be taught from exercises and case studies to illustrate key aspects of technical knowledge and to facilitate skills development. Cases are a very effective and enjoyable way to learn because they recount real life or lifelike business situations that present managers with a dilemma or uncertain outcome. This allows you to evaluate critically the appropriateness of certain accounting treatments and consider these within an ethical context. Cases come from a range of situations and organisations, so you can quickly and efficiently gain a breadth of experience and an appreciation of the limits to your knowledge.

This module introduces the core concepts and key topic areas of business finance and the financial environment. It will enable you to develop knowledge and understanding of how the financial markets operate, evaluate alternative sources of finance available to a business, calculate the cost of different sources of finance and the weighted average cost of capital of a business. You will undertake and critique techniques for capital investment appraisals, and business and financial asset valuation, and analyse critically the efficient market hypothesis, capital structure theories and dividend policies. By completing this module, you will be prepared to study more advanced finance, i.e. financial risk management, in your final year of study.

Pick two of the following modules:

Data Analysis - 15 credits

An understanding of data and an appreciation of the key tools needed to analyse business data is becoming an essential skill for finance professionals. This module introduces you to the topic of data analytics and demonstrates how to apply it effectively in a business context. On this module, you will learn how to select and use tools to extract, validate and analyse data. Communication and visualisation of data, for example by using pie charts or cluster diagrams, will also be covered, allowing you to communicate your findings to both accounting and finance specialists and non-specialists.

Financial Modelling - 15 credits

This module aims to provide you with an understanding of Excel and its application in financial modelling. you will develop proficiency in using Excel, covering the basic Excel tools and advanced functions. By taking this module, you have the opportunity to gain the skills and knowledge that are required in the creation of financial models that accurately reflect a company’s financial performance, such as the financial statements, valuation, sensitivity analysis, etc.

Personal and Business Taxation - 30 credits

This module aims to develop students’ knowledge and understanding of the overall function and purpose of UK taxation in a modern economic context. Students will learn how to calculate corporation tax, value added tax (VAT) and capital gains tax liabilities. In addition, students will learn about, and critically evaluate and analyse, the scope and objectives of UK tax system for business entities, including analysis of the implications of non-compliance and tax avoidance. Finally, on completion of this module, students will be able to recognise the professional standards and ethical issues in relation to a tax practice.

Modules

This module develops an understanding of the key concepts of investments and financial risk management. It introduces the core investment principles and techniques which will enable students to make informed investment decisions. Students will also gain knowledge in sustainable investing, which is an essential area of study within the field of investment in

today’s world. In addition, it will develop students’ knowledge and understanding of the

various types and nature of financial risk. It covers the main frameworks and techniques

concerning the practical aspects of financial risk management.

This module aims to extend student knowledge and application of IFRS to more detailed and

complex areas of reporting. The technical content is mapped to professional qualification

requirements and students will need to pass this module in order to gain full exemptions.

An inquiry guided approach to learning will be adopted with students drawing on the

conceptual framework and accounting standards introduced in level 5 to solve the challenges of reporting in other areas. Inquiry is an active approach to learning which is designed to support students in analysing technical issues, creating valid approaches to reporting and critically evaluating the current IFRS. Students will be exposed to technical articles and scholarly reviews and will be expected to draw on these to make informed judgements and sustain arguments on the reporting of financial transactions. Students will employ analytical skills to interpret financial statement information and develop an appreciation of the uncertainty and subjective nature of financial reporting.

- Strategic Performance Management - 15 credits

- Audit & Assurance - 15 credits

- Strategic Leadership and Governance - 15 credits

- Digital Finance - 15 credits

- Capstone Project: Dissertation - 30 credits

- Capstone Project: Placement for Good - 30 credits

- Capstone Project: Consultancy Project - 30 credits

- Capstone Project: Start Up For Good - 30 credits

Entry requirements

Our offers are typically made using UCAS tariff points to allow you to include a range of level 3 qualifications and as a guide, the requirements for this course are equivalent to:

- A-Levels: EEE from 3 A Levels or equivalent grade combinations

- BTEC/CTEC: PPP from BTEC or Cambridge Technical (CTEC) qualifications

- International Baccalaureate: To include a minimum of 1 Higher Level certificates at grade H4

Additionally, we accept tariff points achieved for many other qualifications, such as the Access to Higher Education Diploma, Scottish Highers, UAL Diploma/Extended Diploma and WJEC Applied Certificate/Diploma, to name a few. We also accept tariff points from smaller level 3 qualifications, up to a maximum of 32, from qualifications like the Extended Project (EP/EPQ), music or dance qualifications. To find out more about UCAS tariff points, including what your qualifications are worth, please visit UCAS.

If you will be over the age of 21 years of age at the beginning of your undergraduate study, you will be considered as a mature student. This means our offer may be different and any work or life experiences you have will be considered together with any qualifications you hold. UCAS have further information about studying as a mature student on their website which may be of interest.

- IELTS Academic at 6.0 overall with a minimum of 5.5 in all four components (for year 1 entry)

- We also accept other English language qualifications, such as IELTS Indicator, Pearson PTE Academic, Cambridge C1 Advanced and TOEFL iBT

If you are living outside of the UK or Europe, you can find out more about how to join this course by contacting our International Recruitment Team via our International Apply Pages.

2026/27 Course Tuition Fees

| UK / Channel Islands / Isle of Man / Republic of Ireland |

International |

|

|---|---|---|

| Foundation year | £5,760 | £16,700 |

Additional tuition fee information

*(UK / Channel Islands / Isle of Man / Republic of Ireland) £5,760 for the 26/27 academic year. Subsequent years of study currently attract fees of £9,790 per academic year. Please see 3 year programme course page(s) for further details. Fees for future academic years will be determined in line with our Terms and Conditions. The fee is currently subject to a governmental fee cap for each academic year. It is our policy to charge tuition fees at the level of the cap set by the Government. If the cap set by the Government changes, then we may increase our Fees in line with governmental policy.

*(International) £16,700 for the 26/27 academic year. Fees for future academic years will be determined in line with our Terms and Conditions. We decide the annual level of increase of our Tuition Fees by taking into account a range of factors including the cost of delivering the course and change in governmental funding.

Remember, you don’t have to pay any of this upfront if you are able to get a tuition fee loan from the UK Government to cover the full cost of your fees each year.

Additional costs

As one of our students all of your teaching and assessments are included in your tuition fees, including, lectures/guest lectures and tutorials, seminars, laboratory sessions and specialist teaching facilities. You will also have access to a wide range of student support and IT services.

There might be additional costs you may encounter whilst studying. The following highlights optional costs for this course:

Mandatory

Volunteering and Placements:

Students will incur travel costs on a mandatory volunteering placement in their Foundation Year (Year 0). Indicative cost: £5 - £30 per day

Optional

Core Text:

It is recommended that you purchase the latest editions of all of the core textbooks. Many of these texts relate to extensive online material for which you require an access code supplied with the textbook. It is possible for students to purchase second-hand copies where applicable. Indicative cost is £50 - £200 per year.

Volunteering and Placements:

You may incur travel costs on optional volunteering placements in the second or third year of study. Indicative cost is £5 - £30 per day.

Smart Clothing:

You may be expected to dress formally for oral assessments. Costs will vary depending on the students existing wardrobe. Indicative cost is £0 - £50.

SCHOLARSHIPS, BURSARIES AND AWARDS

We have a variety of scholarship and bursaries available to support you financially with the cost of your course. To see if you’re eligible, please see our Scholarships and Awards.

CAREER PROSPECTS

Careers

Many of our Accounting graduates take up trainee accounting positions with accounting firms or departments and go on to become professionally qualified accountants. Others choose to enter a wide range of business careers such as banking, insurance, financial services and general management. Recent employers of accounting graduates include Deloitte, RSM, Ordnance Survey, Larking Gowen, Aztec Group and PKF Francis Clark.

The University of Winchester ranks in the top 25 in the UK for graduates in employment and further study according to the Graduate Outcomes Survey 2024, HESA.

Accreditation

The Institute of Chartered Accountants in England and Wales (ICAEW), Chartered Institute of Management Accountants (CIMA) and the Association of Chartered Certified Accountants (ACCA) all offer graduates of this programme exemptions from some professional examinations.

Pre-approved for a Masters

If you study a Bachelor Honours Degree with us, you will be pre-approved to start a Masters degree at Winchester. To be eligible, you will need to apply by the end of March in the final year of your degree and meet the entry requirements of your chosen Masters degree.

OUR CAREERS SERVICE

“My lecturers still show me so much support. They know you by name and as a person, rather than just a number.”